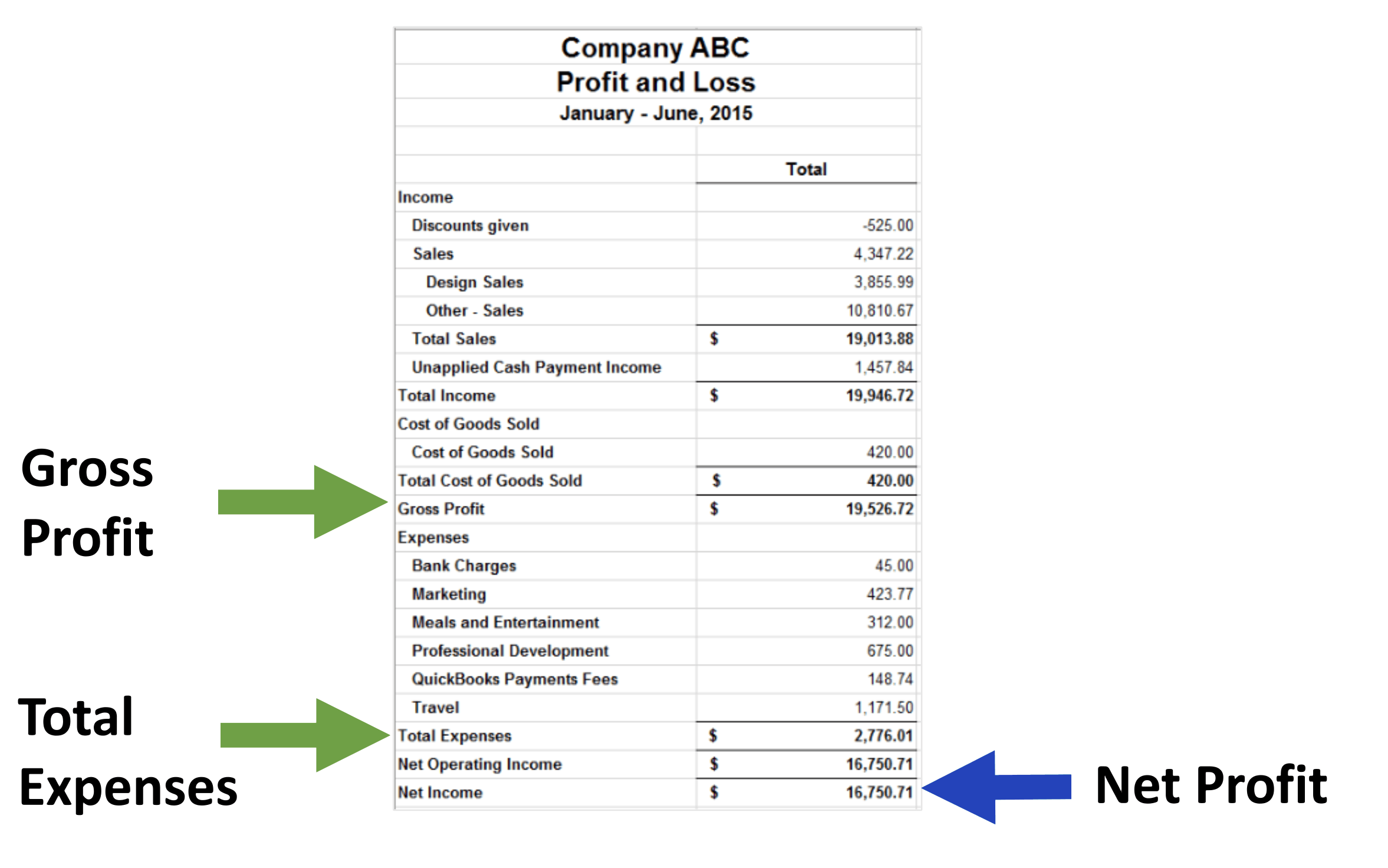

These costs are those that are regarded as indirect, so cost of premises and staff, etc. This gives you a gross profit figure (which at this stage could be a loss, of course).įrom the gross profit figure, you take away overheads and expenses. Taken away from this headline figure is the cost of sales – literally what is cost to produce the goods. This is the money made from selling your goods. To provide an example, first comes the sales, or revenue. It has many distinct levels that give an indication of a company’s situation after certain calculations are made. Now, as with anything that involves finance, the P&L is not purely a simple calculation. And the profit and loss account is usually audited by an external party, such as an accountant. They provide the reader with how well the company has done over the year.įor a sole trader, it’s useful as an illustration as to how they are doing and they could be used to support a loan application, for example. They are usually prepared every year for smaller companies, or twice a year for larger and public companies.

Now, alongside the cash-flow statement and balance sheet, the profit and loss account (P&L) is one of the most important accounts on which a company is judged. But if you sold them for less, you’ve made a loss. If you sold them for more, you made a profit. In other words, from what your goods cost you, take away what you managed to sell them for. On that basic level, profit and loss is derived from taking your costs away from your sales. A profit and loss account (or statement or sheet) is, on a simple level, used to show you how much your company is making or how much it is losing.

0 kommentar(er)

0 kommentar(er)